INV 101: Welcome to our INV 101 course

As the first course in the SOA’s Investment practice area, INV 101 provides the essential foundation for portfolio management. You’ll gain a clear understanding of major asset classes, how portfolios are constructed, managed, and evaluated, and the fundamentals of credit risk management.

With Coaching Actuaries, you’ll learn the material that equips actuaries to excel in situations when investment decisions must be made in the context of significant and complex liabilities.

From Confusion to Confidence: Why Coaching Actuaries?

The sheer volume of material in FSA exams can feel overwhelming, and INV 101 is no different. Our course gives you a clear structure so you always know where to focus. You’ll learn from coaches with deep experience teaching investment concepts, practice with dynamic quizzes and exams, and track your readiness with tools like Mastery Score® and self-graded assignments.

Expertise You Can Trust

Our INV 101 team brings extensive investment knowledge to your studies. Many coaches hold Chartered Financial Analyst (CFA) and/or actuarial credentials and have taught everything from MFE and IFM to all three levels of the CFA curriculum. Their insights will help you connect investment theory to portfolio decisions and to what the exam is most likely to test.

A Familiar and Supportive System

If you’ve studied with Coaching Actuaries before, you’ll recognize our trademark approach right away. And if you’re new, you’ll get up to speed quickly with clear manuals, focused lessons, the CheckPoints scheduler, and a Practice system that keeps you on track. Stay motivated and keep moving forward.

Designed to Maximize Your Time

INV 101 demands efficient study, so we keep you focused on what matters most. Our Concept Checkers reinforce key ideas while Coach’s Remarks help you navigate tricky ideas and understand how topics fit together. Streamlined lessons cut the noise and save you time while CheckPoints keeps you on track and prevents burnout.

Support When You Need It: Get to know your team of experts

With strong subject knowledge and a passion for teaching, our coaches are here to help you confidently tackle INV 101. Their guidance shapes every lesson, so you’re never left guessing. Our coaches also answer questions on the discussion boards within 2 business days.

- Chin Yew Kok

- Shi Yi Wong

- Marc Coward

Aspiring Actuary Testimonials: A Word From Our Students

There’s no better proof than a happy student. After each exam, we follow up to hear about your success and collect your feedback. Your input ensures your experience here is always improving!

It felt like I always had people rooting for my success with every question, exam, or lesson I did.

Jacob Orr Exam P student

Coaching Actuaries is a well-rounded study material that has allowed me to feel confident going into all 6 exams I have taken so far.

Daniel B. Exam SRM student

What You Learn: Laying the Foundation

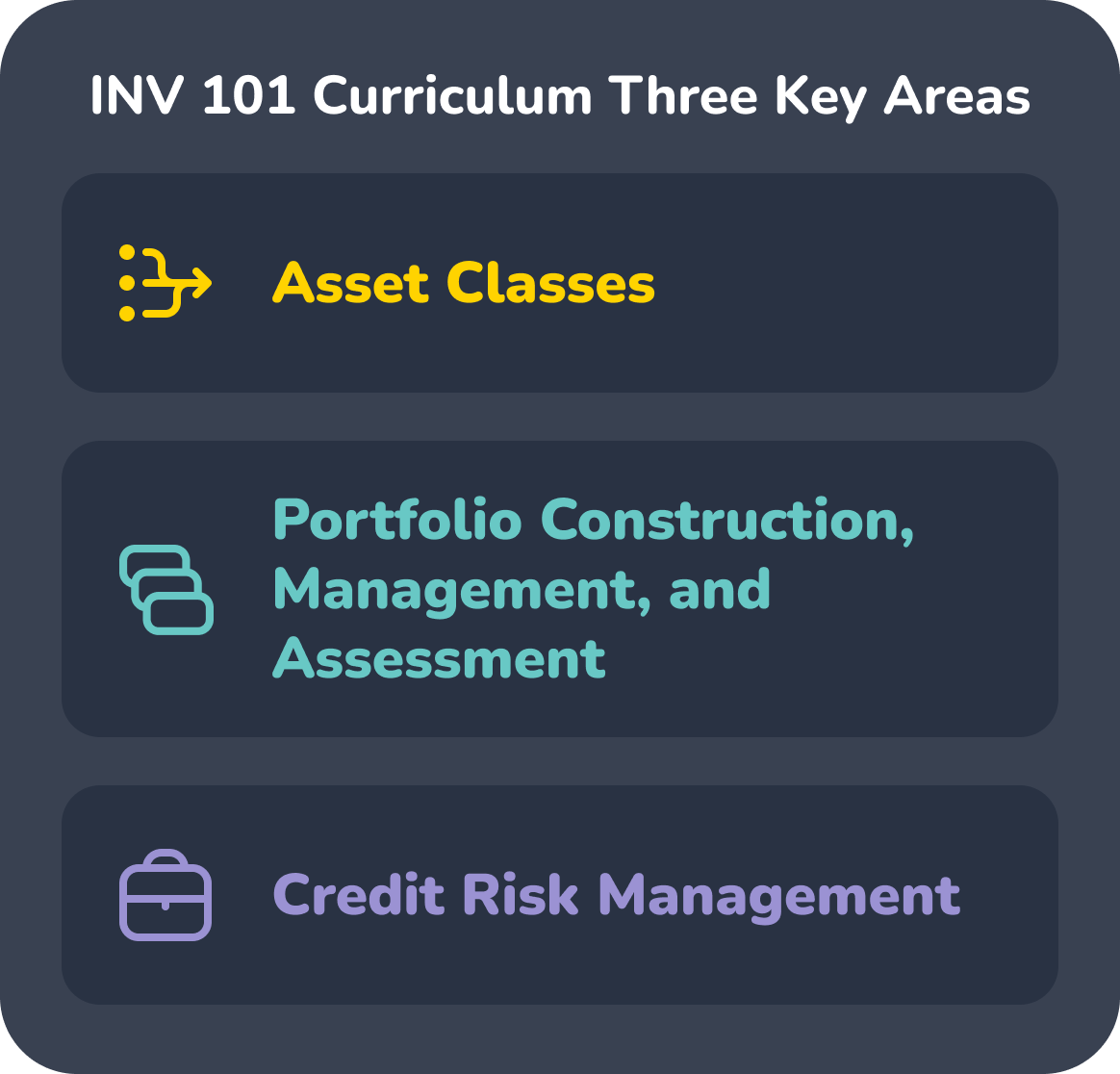

INV 101 sets you up for success on the entire investment pathway. The exam covers three major domains that shape how actuaries approach complex investment decisions.

Understanding Asset Classes

Learn the characteristics, uses, and risks of major asset classes such as equities, bonds, real estate, and alternatives. You will understand how each one behaves, how they interact, and how portfolio managers combine them to meet specific investment objectives.

How Portfolios Come Together

Study how portfolios are built, monitored, and evaluated in practice. You will learn about diversification, optimization, performance measurement, and the core ideas that guide real investment decisions for institutions that must balance risk and return.

Making Sense of Credit Risk

Explore how institutions identify, measure, and manage credit risk. You will learn about industry tools, best practices, and frameworks that influence how credit exposures are monitored and controlled within a portfolio.